Lloyds Bank

*

Strong Customer Authentication

*

Lloyds Bank * Strong Customer Authentication *

2017

Lloyds Bank

Strong Customer Authentication

Improving payment security and reducing fraud are key objectives of the European Union when it comes to online payments. As a result, stricter requirements for authenticating online payments are being introduced in Europe. Known as Strong Customer Authentication, these requirements are part of a broader European payments law, the second Payment Services Directive (PSD2).

Made with the team at Designit

Role

Project lead

Service design

User Experience

Team

Design Researcher

UX Designer

Creative Technologist

Scope

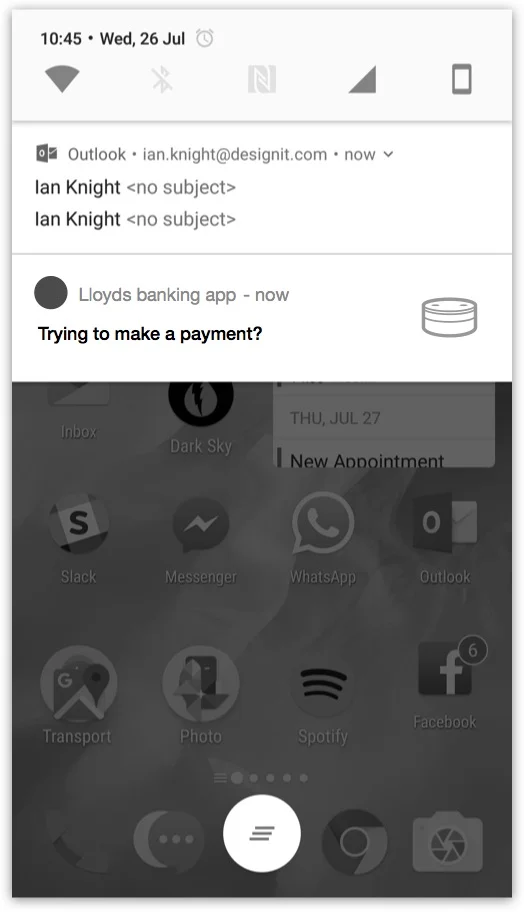

Lloyds wanted to understand the customer experience impact of this new directive. Our challenge was to reframe the requirement for Strong Customer Authentication so that it:

Becomes a positive part of the banking experience

Helps customers to feel safe and confident that their money is secure

Ensures customers are comfortable using multi-factor authentication methods

Continues to build trust in Lloyds

Process

Research

Over 600 pages of documentation provided by client

Market trends, technology enablers, consumer behaviour and changing service expectations

Knowledge transfer

Interviews with 13 bank employees

Contributions from Design Agency; Customer Experience; Customer Labs; Business Banking; Business Architecture; Retail Change; Fraud and Digital Security

Collaboration

Weekly collaboration sessions with UX leads from LBG Design Agency

Co-creation workshop with wider stakeholder group: empathy mapping and service opportunities for extreme scenarios

Outcomes

Experience principles

Guiding creating secure and compliant customer journeys without negatively impacting the customer experience.

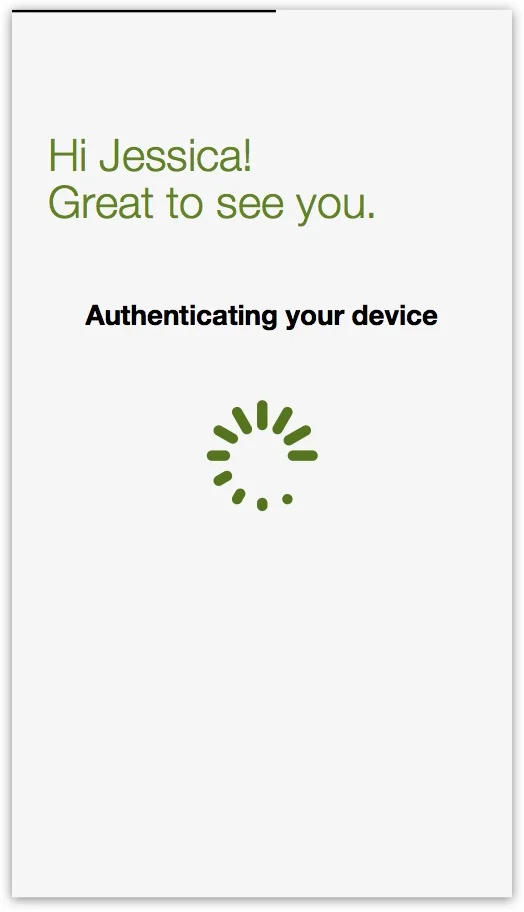

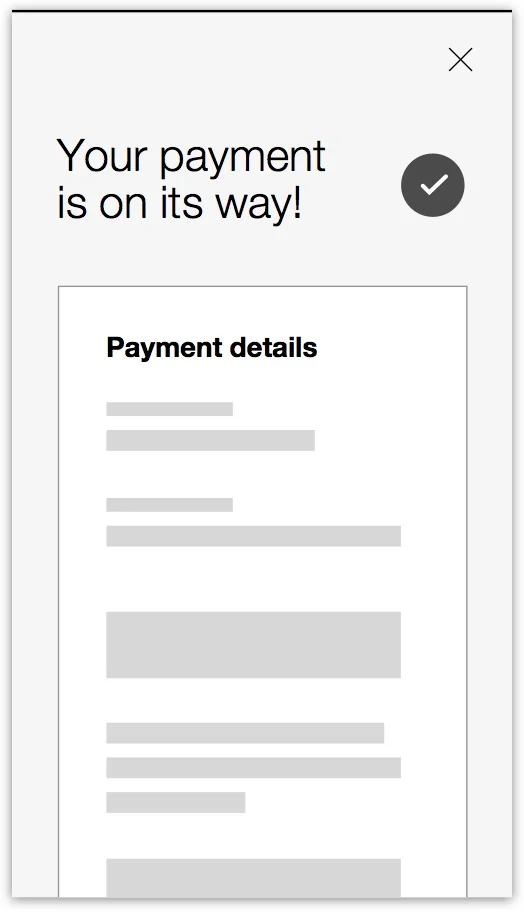

Future vision

Demonstrating a new design model for considerate authentication illustrated through a series of customer journeys.

Implementation considerations

Providing technical considerations a model for step-up patterns and a proposed way forward.